The value of an education is difficult to measure because it is tied to each person’s aspirations, abilities, resources and life circumstances as well as the state a student lives in. These attributes and conditions create opportunity and community benefit. Federal support for higher education may be worthwhile, but it is third party support, sometimes with unintended consequences. The contribution of federally insured loans to increasing college costs is a reality. States should lead with thoughtful policies regarding the support of higher education in all its forms.

Annually, Best Value Schools compiles a list of the most affordable universities in America. Assumptions of the analysis are clearly stated. In-state tuition, size, mission, and other factors reduce the pool of U. S. higher educational institutions from almost 3,000 to less than 700. The costs of education are determined on net price, what a student and/or family actually pays. This includes tuition, federal and state support, scholarship aid, and grants. The analysis also includes room and board. The list, The 100 Most Affordable Universities in America 2015, is a surprising group.

These 100 most affordable institutions are located in only 30 of the 50 states. California claims 13 of the most affordable schools. Texas comes in second with 10. New York, North Carolina, and Louisiana tie for third place, each with eight on the list. Six of the nine schools in Louisiana are in the University of Louisiana System, making it the most affordable system in the nation. Eleven states have only one school each on the list.

Similarity among these five states related to higher education funding and the economic, cultural, and social conditions is a mirage.

Two of the five states, New York and California are heavily unionized, high tax states. The other three are right-to-work, lower cost of living, wage, and taxation states. New York and California reduce attendance costs for residents through tax levies. Citizens likely believe a populace with skills and abilities developed in post high school study have value. I do.

Educational attainment demonstrates appreciation for education’s worth. North Dakota has the highest educational attainment — citizens who hold high school diplomas — of all states. Louisiana has the lowest. Climbing out of the basement Texas, California, and North Carolina are all below the national average. Only New York exceeds that average of 88.4% of the residents holding a high school diploma, all according to the 2012 U.S. Census Bureau.

One might assume in states with low-cost universities that families would carry a large part of the burden. In Pennsylvania families make the most dramatic commitment to pay for education — 23% of the family income is used. Wyoming, a state that traditionally makes a strong commitment to public support of higher education, requires only 9.3% of a family’s income to foot the bill. In Louisiana, 9.7% of a family’s annual income is required to pay for an education. California, the only state in this group of five to exceed the national average, requires 16.9% of a family’s income according The Center for Educational Statistics.

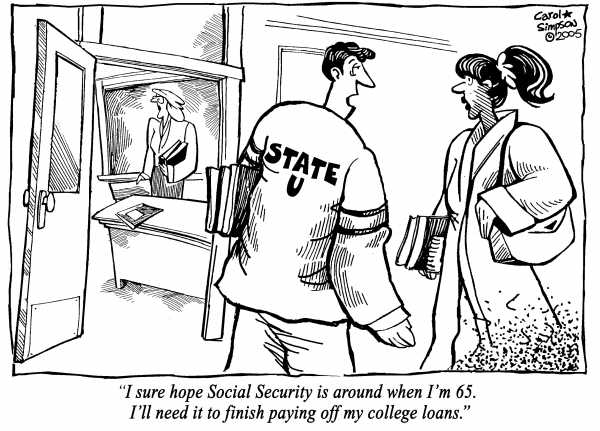

Student indebtedness is off the charts everywhere. Students, many not graduated, owe over $1.2 trillion. Diminishing state support relative to increasing costs triggered a challenging documentary, Starving the Beast. Students borrow more, $5,427 per year, in Alaska than anywhere else in the nation. Vermont has the lowest rate of student borrowing per year at $4,122 annually. New York, California and North Carolina students borrow less than the national average of $4,608 per year. Louisiana and Texas tend to borrow more heavily at $4,847 and $4,723 respectively, surprising given the affordability of colleges in those two states. Illinois students, although in a traditionally a high aid state, borrow $4,696 apiece.

State support, compared to federal assistance through Pell Grant’s, aid for low-income families, varies widely. The national average for a state’s contribution to help low-income families is 45.9% of the amount of federal aid granted. New York, the chart topper, achieves an 88.3% match. North Carolina and California both come in above the national average. Texas falls below the national average at 32% and Louisiana is near the bottom of the list of state matching funds for low-income families at 7.8%, according to The National Center for Higher Education Management Systems.

The national average graduation rate for college students is an anemic 55.5%. In the five states with low-cost schools, California, New York, and North Carolina, all graduate at rates higher than the national average: Texas and Louisiana fall below it.

These observations are important; they are key parts of the increasingly limiting and burdensome costs of completing college. Every person, and each state, is different.

Choose strategically, borrow as little as possible. Education is not a business, but everyone should approach education in a business-like fashion.

Support elected officials that thoughtfully support affordability with action, not talk.

Photo Credit: cartoonwork.com

What a bunch of BS!! It is NOT the state’s responsibility to pay for anyone’s education!!! It is THEIR individual responsibility! If they want to go to college then by all means, go to college!! Get the money from your parents, borrow the money, actually do what most of us did for decades and GET A JOB in the summer and hold at least a part-time job during school (even though my children did NOT have to hold a job due to my financial status, they either held a job or I did NOT support them). I am realllllllly tired of all this whining about someone else being even remotely responsible for someone else’s education!! As a last resort for most of these weak minded and even weaker charactered individuals, go do a stint in the military and when you get out you will have EARNED the right to a free college education!!!

1. A democracy that Indentures its students/families pre-K to post-16 to banks .. read: USA, is not a democracy .. Walter, if that matters.

2. American universities and secondary schools (read: institutions) for the rank and file are places for: 1) learning to read the laws of the land and 2) serving employment apprenticeships. The notion of freedom is spelled in dollar signs not knowledge. We have what Jefferson warned against: “If a nation expects to be ignorant and free, in a state of civilization, it expects what never was and never will be.”

3. Walter, if American Employers will only employ persons with university degrees then employers should bare the cost of that education. More than enough money is available. Ie, parimutuel betting is legal…pick a number and apply it to all stock/commodity bets. Students receiving “parimutuel educations” (IMO) would be responsible for 2 years of national service: teaching, healthcare, conservation, social service.

4. In 1956-8 I attended UCD/’earned’ a Masters Degree. Tuition was $56 a semester and books less than that. On weekends and off-days, I drove to the Fairfield area/picked apricots, peaches and plums. I made between $8-$14 a day. I ‘paid’ for my UCD ‘education’ with 4 weekends of work. And today .. you do the numbers.

Thanks for your note.